IR35

What does IR stand for in IR35. IR35 is tax legislation intended to stop disguised employment.

Ir35 Q A Inside Ir35 Considerations For Contractors Microsoft Technology Jobs Recruitment Youtube

On September 23 the UK Government announced their mini-budget.

. September 23 2022 134 pm. The legislation was designed to stop contractors working as disguised employees by taxing them. The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget.

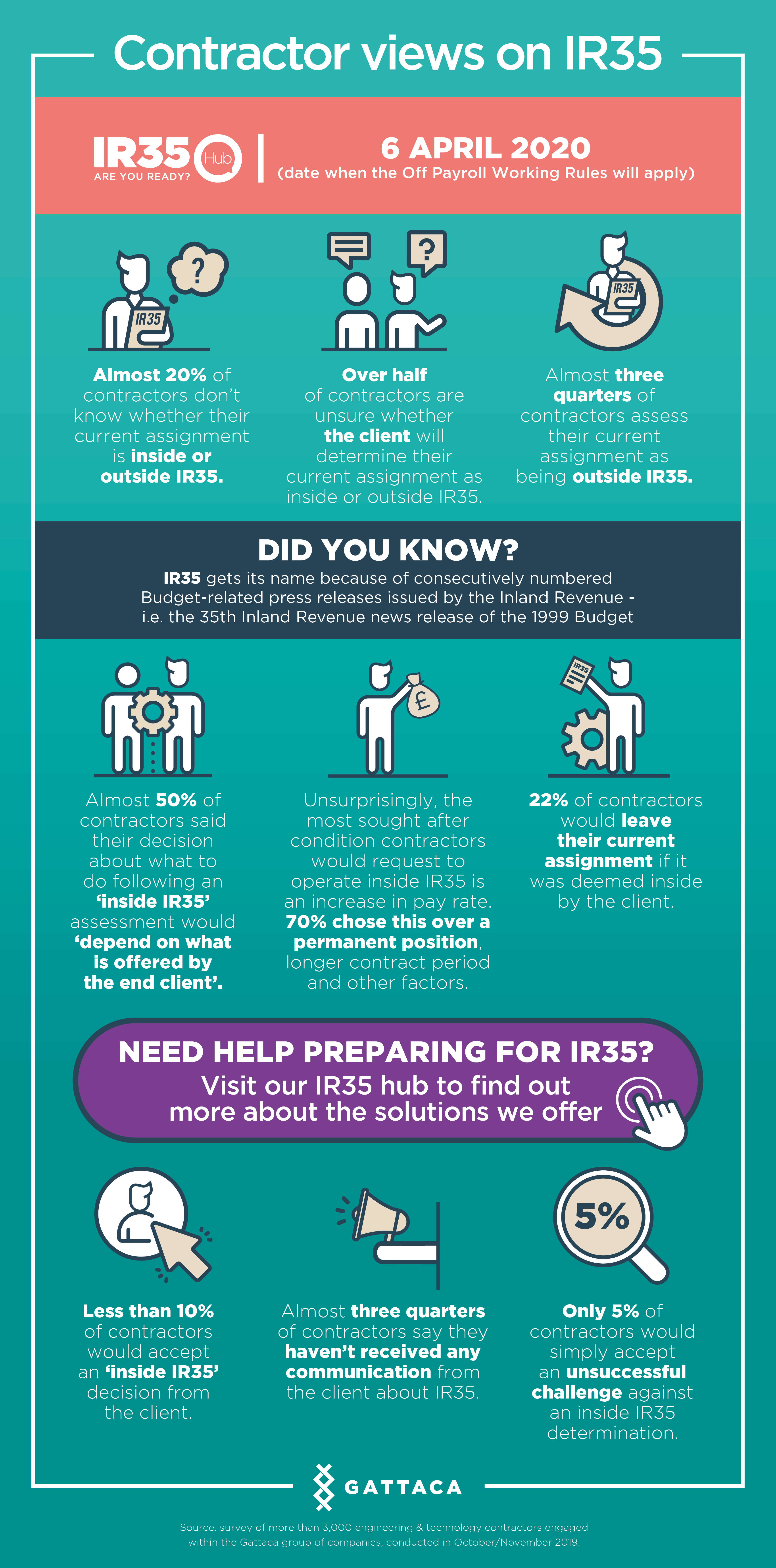

The term IR35 refers to the press release that originally announced the legislation in 1999. List of information about off-payroll working IR35. Printable princess coloring pages.

Apply online for Project Interface Manager IR35 job New York USA. Jobs Local US Jobs Register Advertisers Online Edu TOEFL TEFL Visas. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a.

While IR35 had previously been present within the. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000. IR35 is another name for the off-payroll working rules.

IR35 affects all contractors who do not meet HMRCs definition of self-employment. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees. The term IR35 refers to the press release that originally announced the legislation in 1999.

IR35 refers to United Kingdom s anti-avoidance tax legislation designed to tax disguised employment at a rate similar to employment. In this context disguised employees means. The IR stands for Inland Revenue and.

Ad Global Leader In Industrial Supply And Repair Services. And in a surprising twist IR35 changes off-payroll working rules will be repealed from April. Speaking to the House of Commons today September 23 Chancellor Kwasi.

Wed like to set additional cookies to understand how you use GOVUK. In general IR35 shifts the responsibility of worker. Self-employed IR35 rules are.

Browse Our Site Today. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their. Portable air conditioners at walmart.

There is a set of specific criteria that HMRC uses to decide whether or not a contractor is an employee based on case law from previous rulingsA basic rule of. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties.

We use some essential cookies to make this website work. Post management jobs for free. IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company.

Microsoft is dedicated to ensuring Finance and Operations is the most robust fully functional ERP system on the market and is showcasing that with each product update. The off-payroll working rules apply on a contract-by. Below are seven of.

IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000.

The Ir35 Changes Are Here What Does It Mean For You Rouse Partners Award Winning Chartered Accountants In Buckinghamshire

What Is Ir35 And How To Close Down A Personal Service Company

What You Need To Know About The Uk Ir35 Rules Goglobal

What Is Ir35 A Guide To Its Rule Changes

Our Comprehensive Guide To Ir35 Aston Shaw

Ir35 Shock As Chancellor Jeremy Hunt Says Contractors Must Pay Same Tax As Employees It Contractor It Contracting News Advice

Ir35 Changes 2020 2021 Guidance For Contractors Updated Taylor Hopkinson

What Is Ir35 Changes To Ir35 And How They Affect Your Business

Changes To The Off Payroll Working Rules Ir35 Meridian

How Will Designers Be Affected By Changes To Ir35 Design Week

Ir35 Finance Concept United Kingdom Tax Law Tax Avoidance 7136286 Stock Photo At Vecteezy

Ir35 New Hmrc Consultation On Reform Of Off Payroll Tax Rules Jurit